Your trusted partner for Merchant Processing Solutions

We put $$ back in your pocket

Your trusted partner for Merchant Processing Solutions

We put $$ back in your pocket

Business Funding

No hard credit pull

6 Months Bank Statements

$20K - $1Million

in Working Capital Amount

1-3 Days

Funds Received Fast

Merchant PROCESSING Solutions

Unlock the potential of seamless payment processing with PayDriven. As a leading merchant processing business, we empower businesses across industries to optimize their payment solutions and drive growth. With our secure, efficient, and reliable payment processing services, you can streamline transactions, increase customer satisfaction, and boost your bottom line.

Whether your business is online or in person, we want to help you with all your payment needs. Contact us now to learn more and schedule a consultation. Together, let's unlock your business's full potential while putting money back in your pocket.

Payment Terminals for Small Business

POS Systems & Software Integrations

Virtual Terminals & Gateways

Mobile Payments

eCommerce Solutions

Value Added Services

Easily Accept All Major Payment Types

Industries We Serve

Restaurant & Food Business

Retail

Service

Legal

Medical

Ecommerce

High Risk

Our Blog

Business & Payments News

What Is Payment Processing? How It Works + Why It Matters

Let’s get one thing straight: if you’re running a business in 2025 and still treating payment processing like a backend necessity instead of a business advantage, you’re already leaking money.

Whether you run a boutique salon, a fast-scaling e-commerce store, or manage a multi-location business, how you process payments isn’t just about getting paid — it’s about how much you keep after you do.

And if you’re not being strategic, you're likely:

Overpaying in hidden fees

Using outdated tools

Ignoring security risks

Losing customer trust

In this guide, we’re breaking down what payment processing really is, how it works, where the money actually goes, and how to turn your payment setup into a powerful profit lever.

What Is Payment Processing?

At its core, payment processing is the behind-the-scenes tech and banking infrastructure that moves money from your customer’s credit card or bank account into your business account.

It handles:

Card transactions (in-person and online)

Mobile wallet payments (Apple Pay, Google Pay)

ACH and bank transfers

Subscriptions and recurring billing

It’s what allows your business to say: “Yes, we take cards” — and actually get paid safely and efficiently.

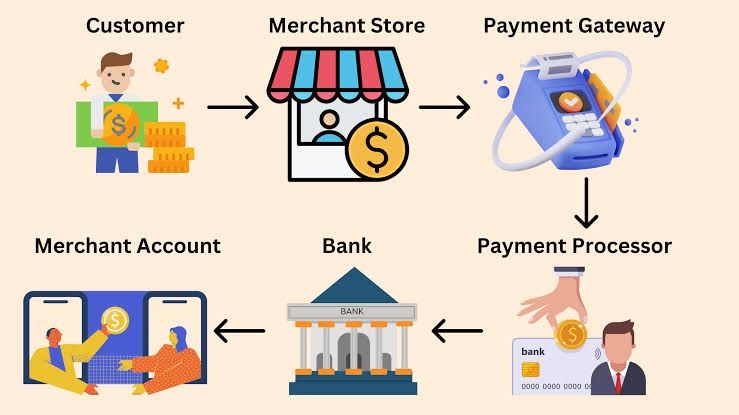

How Payment Processing Works (Behind the Swipe)

Let’s simplify what’s usually a black-box process:

1. Customer Pays

They tap, swipe, insert, or enter their card or digital wallet info.

2. Authorization

The payment is routed from your processor to the issuing bank to check:

Is the card valid?

Are there enough funds?

Does it trigger any fraud alerts?

This takes milliseconds.

3. Authentication

Depending on the method (chip, contactless, CNP), the customer may be asked to verify the purchase via PIN, signature, or 2FA.

4. Settlement

The card networks (Visa, Mastercard, etc.) move the funds from the customer's bank to your business’s acquiring bank — after taking their cut.

5. Funding

You receive the payment, usually within 1–2 business days. Same-day funding is available from select providers.

The True Cost of Payment Processing: Where Your Money Goes

Every time a card is swiped, multiple players get a slice of the pie:

Interchange Fees (Set by Card Networks)

Paid to the issuing bank (your customer’s bank)

Non-negotiable

Based on card type, transaction method, and risk level

A majority of your credit card processing fees will come from here. The rates for these will vary depending on various factors, including the type of card used, card brand, processing method and type of business. These rates are also not fixed so they're constantly fluctuating depending on various market factors. The rates monthly, weekly or even daily depending on the economy, interest rates, trades, and even currencies.

Assessment Fees

Charged by the card networks (Visa, Mastercard)

Also non-negotiable

These fees generally aren't as high as interchange fees, usually very small, but they still take away a small percentage which eats into the merchant's profit. These fees also do not fluctuate like the interchange fees do. Unlike interchange fees which vary per transaction, assessment fees are based on overall monthly sales volume.

Processor Markup (Where You’re Being Overcharged)

This is the fee your processor adds on top

Often where hidden costs live

May be structured in flat-rate, tiered, or interchange-plus models

This is where it gets tricky. It’s what your processor charges on top of interchange — and this is where most overpay.

Flat-rate processors like Square, PayPal or Stripe are convenient when you're starting out, but once your volume crosses $10K/month, that simplicity can cost you thousands.

Pricing Models Explained

1. Flat Rate

Simple. One consistent fee (e.g., 2.9% + $0.30).

✅ Easy to understand

❌ Often more expensive for businesses doing $10K+/month

2. Tiered

Transactions are classified into “qualified,” “mid-qualified,” or “non-qualified.”

❌ Lack of transparency

❌ Easy to bury costs

🚩 Often used by processors that mark up heavily

3. Interchange-Plus (Best Option)

Your processor charges the true interchange + a transparent markup (e.g., 0.30% + $0.10).

✅ Most cost-effective for growing businesses

✅ Transparent

✅ Easy to audit

Pro Tip: At PayDriven, we audit merchant statements to reveal which model you're on and where you’re overpaying.

Types of Payment Processing Setups

Different businesses need different tools. Here's a quick cheat sheet:

In-Person (Retail)

In-person payments. also known as "card present" payments is exactly what it says - the card is physically present and the payment is processed in-person. The customer presents their card in person and the card is swiped, tapped or inserted to accept the payment.

POS systems, smart terminals

Contactless payments, tipping, receipt printing

Great for: retail, restaurants, service providers

Online (E-commerce)

Unlike traditional retail businesses, many businesses do not have a physical presence and can't take in-person payments. Online payments is another popular method of accepting payments in today's day and age.

Hosted checkout, APIs, gateways (like NMI, Authorize.net)

Subscription support, saved cards

Great for: product-based businesses, SaaS, consultants

Mobile

With the explosion of cell phones, tablets and other mobile devices, mobile payments are a great way to accept payments while on the go, whether you're in a physical store, at an event or traveling. You're no longer limited to large POS devices or traditional payment terminals.

Tap-to-pay readers, apps like Clover Go or SwipeSimple

QR codes or text-to-pay options

Great for: tradespeople, mobile services, events

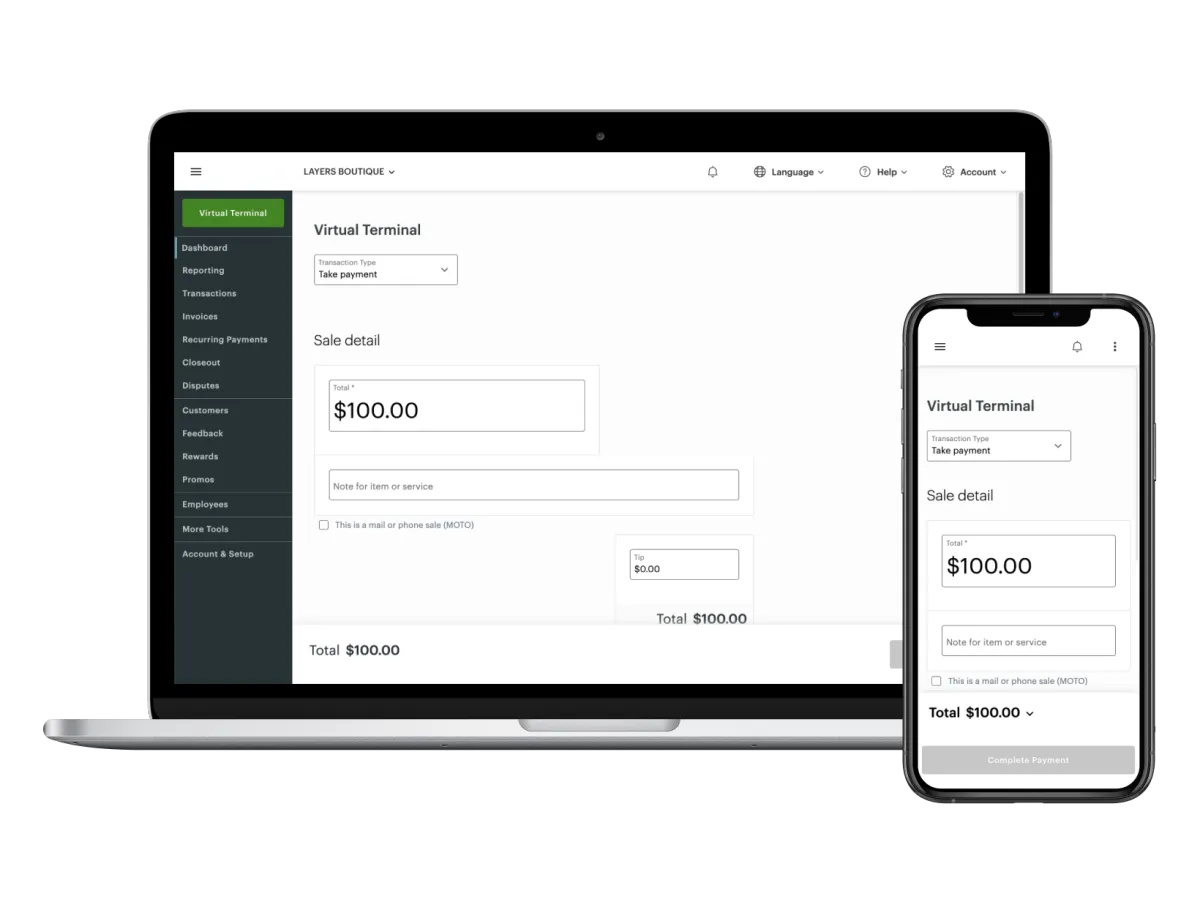

Virtual Terminal

A virtual terminal is a secure way of accepting payments without a physical terminal, whether online or by phone. It enables you to enter your customer's card information and charge them for your product or service.

Accept payments via phone or manual entry

Ideal for: remote billing, medical offices, coaching, professional services

Recurring & Subscription Billing

Auto-drafts, failed payment recovery, dunning tools

Must-have for: gyms, coaching, SaaS, memberships

Security, Compliance, and Risk Management

Payment processing isn’t just about convenience — it’s about protection.

Key Terms to Know:

PCI DSS Compliance: Payment Card Industry Data Security Standard. If you accept cards, you must comply.

Tokenization: Replaces sensitive data with unique identifiers (tokens) to keep it safe.

Encryption: Secures data in transit so hackers can’t intercept it.

Chargeback Management: Tools and processes to fight fraudulent disputes.

Real Talk:

If your processor doesn’t actively help you stay PCI-compliant or fight chargebacks, they’re not doing their job.

Why Businesses Overpay (And Don’t Even Know It)

We’ve audited hundreds of merchant statements and these are the biggest red flags:

Flat rate pricing after scaling past $15K/month

Tiered pricing with “non-qualified” surprises

PCI non-compliance fees that never get resolved

Poor terminal support leading to downtime

No chargeback protection tools in place

One LA-based med spa we worked with was doing $120K/month and losing over $22K/year in unnecessary fees — all because they didn’t know to ask the right questions.

Why Work With a Payment Consultant Like PayDriven?

You wouldn’t blindly sign a lease without reading the fine print. So why are you trusting your revenue stream to a faceless processor with fine print you don’t understand?

Here’s what PayDriven does differently:

Transparent Rate Audits

We break down your statements line-by-line — no jargon.Custom Setup for Your Business

From luxury med spas to boutique gyms, we build setups that match your industry and scale.Future-Proof Tools

From Apple Pay to tap-to-phone, we set you up to accept the latest tech.Chargeback Support

You shouldn’t have to fight alone — we help you win more cases.Faster Funding

Need your money faster? We help you qualify for next-day or same-day deposits.

Use Case: Real Business, Real Results

Client: High-volume wellness studio in Manhattan

Before: Paying 3.7% flat rate on $80K/month = $2,960/month in fees

After PayDriven: Switched to interchange-plus (1.87% effective)

Savings: Over $1,400/month — nearly $17,000/year

That’s not theory. That’s math.

Future Trends in Payment Processing

Tap to Pay on iPhone & Android: No terminal needed — just your phone.

Buy Now, Pay Later (BNPL): Drives conversions for high-ticket products.

AI Fraud Detection: Real-time learning models to stop chargebacks before they happen.

Crypto Acceptance: Growing in specific industries (especially international or tech-savvy buyers).

Embedded Payments: Platforms integrating payments directly into their services (e.g., scheduling apps, CRMs).

FAQ: What Business Owners Want to Know

Q: Is payment processing safe for my business?

Yes — if you're PCI-compliant and using encryption and tokenization. Always work with a processor who handles compliance for you.

Q: What’s the best processor for small businesses?

It depends. Stripe and Square are great for new businesses. But once you're doing $10K+/month, you’ll usually save more with a custom setup from a consultant like PayDriven.

Q: Can I pass processing fees to customers?

Yes, in many states, surcharging or “cash discount” programs are allowed — but they must be implemented correctly or you risk legal trouble.

Q: How fast can I get my money?

Typical funding is 1–2 business days, but PayDriven helps qualifying businesses access same-day or next-day funding options.

Q: What’s a chargeback and how do I fight one?

A chargeback is when a customer disputes a transaction. You can fight back by submitting evidence. PayDriven provides support and guidance on increasing your win rate.

Final Word: Payment Processing Should Make You Money — Not Cost You Thousands

Here’s what they won’t tell you:

Payment processors are banking on your silence. The less you ask, the more they make.

But that ends here.

If you're tired of overpriced rates, generic service, and statements you can’t decipher — we’re here to help.

Book a free cost saving analysis with PayDriven today

We’ll show you how much you’re overpaying, and how to fix it — no BS, no sales pressure.

Visit www.getpaydriven.com to get started.

Los Angeles, CA | New York, NY

(888) 546-7656